In the previous review, we discussed the fact that a strong euro is not beneficial to the European Union or the European Central Bank (ECB). Of course, the exchange rate should not be excessively low, as this would undermine trust in the currency on global markets. However, it should not be too high either. In recent months, both ECB President Christine Lagarde and Chief Economist Philip Lane have brought up the issue of the euro's strength, making it clear that the elevated exchange rate is becoming problematic for the EU.

Even with trade agreements being signed, Donald Trump's tariffs have contributed to new economic challenges in the bloc. The EU economy has been struggling for years, with sluggish growth rates. Trump's policies reduced exports from the EU to the United States — a major blow to German and French manufacturers, as the U.S. is the world's largest market. When foreign demand drops, production volume must also decline. This, in turn, leads to declining revenue, layoffs, reduced investment, and other undesirable consequences.

It's also important to emphasize that France and Germany, together, account for half of the GDP of the European Union. Therefore, when these two countries are in trouble, the entire bloc feels the impact. In addition, the euro has appreciated by 16% against the Chinese yuan over the past three years. This has made Chinese exports to the EU more competitive, reducing demand for European-made goods even within the bloc.

Chinese goods have always been attractive due to their low prices. In recent years, quality has improved significantly, while prices have remained stable. The yuan's depreciation against the euro has made Chinese products even more appealing to European consumers.

As such, the more expensive the euro becomes, the greater the decline in demand for European products — even locally. The EU has essentially lost the trade war with the United States when Ursula von der Leyen signed what many called an unbearable deal with Donald Trump. Now, the EU is losing ground to China due to the weak yuan.

I've already speculated that the ECB may be covertly working to stabilize the euro's exchange rate, although there is no official confirmation of this. It's worth noting that currency targeting is informally discouraged. For example, the Swiss National Bank (SNB) began intervening in the foreign exchange market and immediately came under heavy criticism from Washington. Simply put, if all central banks begin intentionally undervaluing their currencies, it could lead to chaotic monetary policy worldwide.

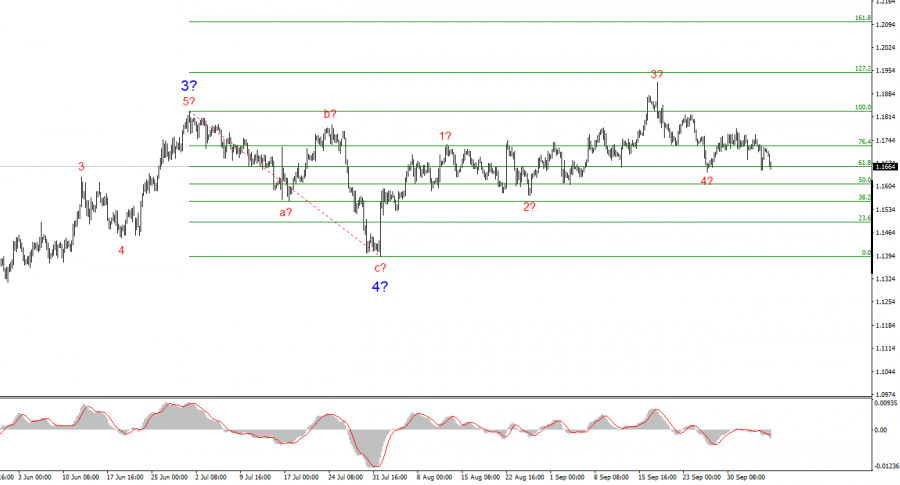

Based on the analysis of EUR/USD, I conclude that the pair continues forming a bullish wave structure. The current wave count is entirely dependent on the news backdrop, including decisions from Trump and the foreign and domestic policies emerging from the White House. The targets of the ongoing bullish wave may stretch as far as the 1.2500 area. At present, corrective wave 4 appears to be forming — and may already be complete. The upward wave structure remains intact. As such, I am only considering buy positions in the near future. My forecast for year-end is a move toward 1.2245, which corresponds to the 200.0% Fibonacci.

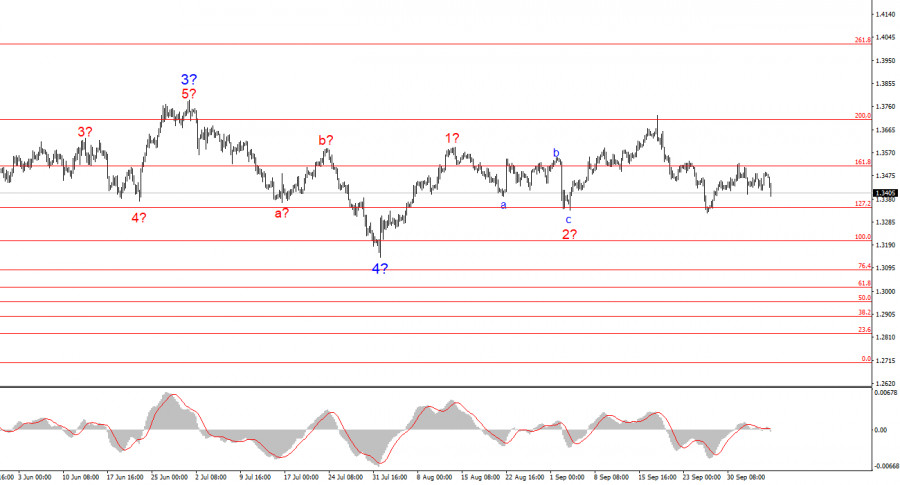

The wave structure of the GBP/USD pair has evolved. While we are still in the midst of a bullish impulse wave, the internal pattern is becoming unclear. If wave 4 takes the shape of a complex three-wave formation, the overall structure will normalize. However, this would make wave 4 much more complex and extended than wave 2. In my view, the market should now focus on the 1.3341 level, which corresponds to the 127.2% Fibonacci. Two failed attempts to break this level indicate renewed buying interest. The upside target remains above the 1.3800 zone.