Praha – Čistý zisk Komerční banky (KB) v letošním prvním čtvrtletí stoupl meziročně o 49,3 procenta na 4,2 miliardy korun. Celkové výnosy se meziročně zvýšily o 3,5 procenta na 9,1 miliardy korun. Banka, jejímž většinovým vlastníkem je francouzská Société Générale, dnes neauditované konsolidované výsledky zveřejnila na webu.

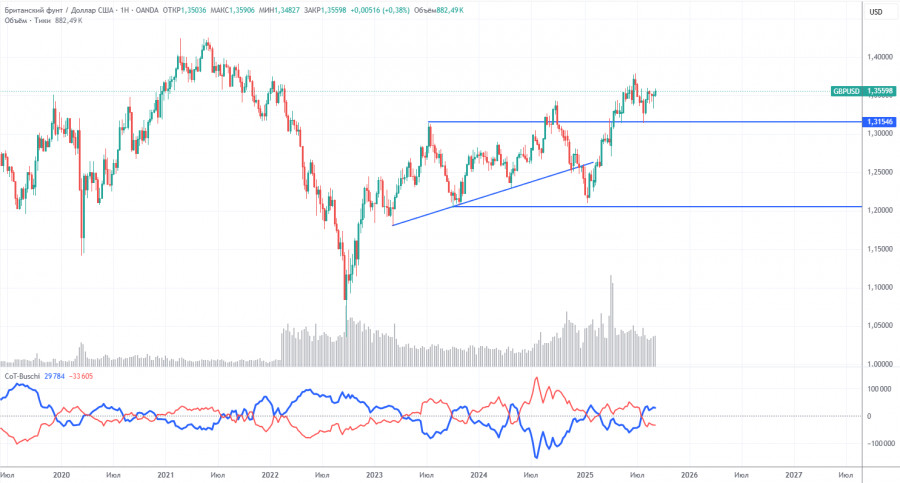

On Tuesday, the GBP/USD currency pair also continued to move north, though not as strongly as EUR/USD. The uptrend on the hourly timeframe remains, as evidenced by the trendline, while UK statistics released yesterday morning had no real effect on the pound's growth. All three UK reports published were dull and neutral, almost exactly matching economist forecasts. They simply couldn't provoke a rally throughout the day. The same applies to US data (industrial production, retail sales), which also beat forecasts and should have supported the dollar, not the pound.

However, the US currency still has plenty of fundamental reasons for decline, and today and tomorrow, the central banks of both the US and the UK will hold their regular meetings, the results of which are 90% likely to favor the pound. We wouldn't rule out that the market is already starting to price these in. In general, even without the Fed and Bank of England meetings, the market has plenty of reasons for continued buying. Traders now expect only a rate cut from the Fed and a prolonged pause from the BoE. On the daily chart, the price has clearly corrected within the uptrend, so upward movement can continue.

On the 5-minute chart, there was precisely one trading signal yesterday, but it was more than enough to profit. At the very start of the European trading session, the pair broke above 1.3615, allowing traders to open long positions. Afterwards, the price only continued to rise.

COT reports on the British pound show that commercial traders' sentiment has been constantly changing in recent years. The red and blue lines (net positions of commercial and non-commercial traders) cross frequently and generally stay near zero. Right now, they're almost at the same level, which signals roughly equal amounts of long and short positions.

The dollar is still falling due to Trump's policies, so market maker demand for the pound is not so important right now. The trade war will continue, one way or another, for a long time. The Fed will lower rates at least once more within the next year, so dollar demand will keep falling. The latest COT report shows "Non-commercial" closed 1,200 BUY contracts and 700 SELL contracts. So, the net position decreased by 500 contracts during the reporting week.

The pound shot up in 2025, but the cause is clear—Donald Trump's policy. Once that factor is neutralized, the dollar could rally, but no one knows when that will happen. It doesn't really matter whether the net position in the pound rises or falls—the dollar's net position keeps shrinking, usually at a faster pace.

On the hourly timeframe, GBP/USD is poised to form a new uptrend, which it is currently doing. The fundamental and macroeconomic backdrop for the dollar is still negative, so there's still no reason to expect medium-term dollar growth. This week, there could theoretically be a GBP pullback, but you'd need technical signals for that—such as a break of the trendline.

For September 17, we highlight these important levels: 1.3125, 1.3212, 1.3369–1.3377, 1.3420, 1.3525–1.3548, 1.3615, 1.3681, 1.3763, 1.3833, 1.3886. The Senkou Span B (1.3460) and Kijun-sen (1.3581) lines may also serve as signal sources. A Stop Loss should be moved to breakeven after 20+ points in your favor. The Ichimoku indicator lines can shift during the day, so keep that in mind for signal generation.

On Wednesday, an important UK inflation report will be released, but it's unlikely to affect the BoE's policy outcome. Still, a high inflation figure may fuel new pound growth, as the BoE stance will become less "dovish." In the US, the Fed meeting and a press conference with Jerome Powell are scheduled.

We believe that on Wednesday, the pair's bullish movement can continue, as nearly all factors point in that direction. The 1.3615 level has been surpassed, so targets are 1.3681 and 1.3763. Shorts are theoretically possible, but we wouldn't risk them at the moment.

RYCHLÉ ODKAZY