Společnost Booz Allen Hamilton (NYSE: BAH) oznámila za čtvrté čtvrtletí zisk na akcii ve výši 1,61 USD, což odpovídá odhadům analytiků ve výši 1,61 USD. Tržby za čtvrtletí dosáhly 2,97 mld. USD oproti konsensuálnímu odhadu 3,03 mld. USD.

The EUR/USD currency pair showed no movement on Thursday, as the forex market was closed. However, a holiday is not an excuse to relax; rather, it is an opportunity to conduct a deep analysis. Moreover, with the New Year approaching in just a week, it would be prudent to understand what to expect.

At first glance, everything is clear as day. Technically, on the daily timeframe, the pair continues to oscillate in the range of 1.1400-1.1830 for six months now. In recent weeks, the price has been inching closer to the upper boundary, and we are almost certain that a breakout will happen in the near future. In this case, the global upward trend that began in January 2025 (and can arguably be traced back to 2022) will resume. It is worth noting that over the past six months, the dollar has corrected by 23.6% according to Fibonacci. Thus, there has been essentially no correction. Therefore, if there is no correction, the trend should resume.

From a fundamental perspective, things are a bit more complicated, although they also seem very straightforward at first. In 2025, the dollar fell while ignoring the monetary policies of both the Federal Reserve and the European Central Bank. Recall that in the first half of the year, the ECB was actively lowering its key rate while the Fed maintained the status quo. Under such circumstances, the euro should have plummeted while the dollar should have risen. However, Donald Trump's policies, particularly the trade war, had their effects. The trade war is expected to continue in 2026, as it seems that no court in the world would dare to declare Trump's tariffs illegal. Even if a miracle occurs and the Supreme Court cancels the tariffs, the White House leader will immediately impose the same tariffs under a different law. Then, a couple of years of new legal disputes will ensue to determine whether Trump had the right to impose tariffs based on the new legislative act. And this cycle could go on indefinitely.

Another important fundamental factor is the convergence of monetary policy between the ECB and the Fed. The ECB has reached the "bottom" concerning rates, while the Fed is crawling toward "the bottom." Recently, some members of the Fed's "dovish" wing have stated that the key rate should be 1% lower than its current value. However, we are quite confident that Trump would prefer an even softer monetary policy. In May, Jerome Powell will step down as Fed Chair, and the FOMC will add a new "dove" appointed by Trump. Once the number of "his people" on the FOMC exceeds six, the rate can be lowered to any value. Predicting Trump's actions and desires is akin to reading tea leaves. The current Republican president seems to agree to a rate lower than the present one by 1%, but in a year's time, he might demand a 2% cut. Meanwhile, the ECB will either keep rates unchanged in 2026 or raise them. Hence, ECB and Fed rates will converge in 2026, which favors the euro.

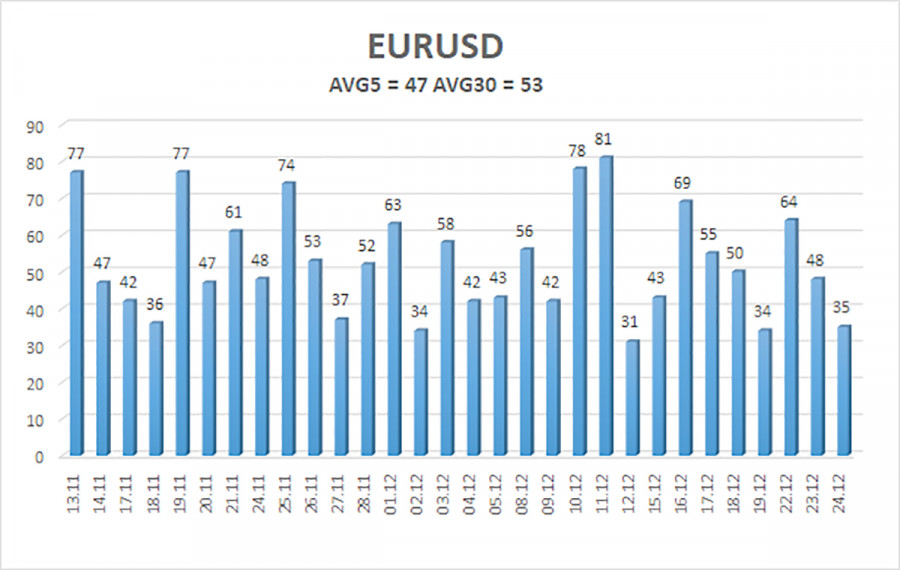

The average volatility of the EUR/USD pair over the last five trading days as of December 26 is 47 pips, characterized as "medium-low." We expect the pair to trade between 1.1735 and 1.1829 on Friday. The upper channel of the linear regression is turning upwards, but in reality, a flat continues to occur on the daily timeframe. The CCI indicator entered oversold territory twice in October but visited overbought territory at the beginning of December. A downward pullback is possible, which we are already observing.

The EUR/USD pair is positioned above the moving average line, with an upward trend persisting across all higher timeframes, while a flat has continued for the sixth consecutive month on the daily timeframe. The global fundamental backdrop remains crucial for the market and negative for the dollar. Over the past six months, the dollar has shown intermittent weak growth, exclusively within the sideways channel. For long-term strengthening, it lacks fundamental support. If the price is below the moving average, minor shorts can be considered with a target of 1.1698 on purely technical grounds. Above the moving average line, long positions remain relevant with targets at 1.1829 and 1.1830 (the upper boundary of the flat on the daily timeframe), which have practically already been targeted. Now we need the flat to conclude.

RYCHLÉ ODKAZY