The GBP/USD currency pair remained relatively stable throughout Tuesday. This is not surprising, as the European trading session has once again incited a desire to close charts and go for a walk. The American session was traditionally more active, but there was a lack of macroeconomic background, with no fundamental events occurring. Thus, the GBP/USD pair remains within a downward correction that could end at any moment.

While the euro has corrected by nearly 61.8%, the pound has corrected by only 38.2%. This week's upcoming Bank of England meeting is still considered an important event by many traders. I want to remind you that in 2025, the dynamics of the dollar were 100% determined not by the Fed's monetary policy, the largest central bank in the world. The dollar has been falling for the second consecutive year based on Donald Trump's policies. If we consider the trend from the very beginning, the dollar has been depreciating for four years now. However, from 2022 to 2024, the reasons lay in the Fed's monetary policy, whereas now it's due to Trump's policies.

Recall that in the fall of 2022, inflation in the US began to slow down from record levels. At that time, the market began to anticipate an easing of the Fed's monetary policy. Since then, the Fed has reduced rates seven times. That's neither a lot nor a little, but the market clearly expected more and priced in larger rate reductions. If you remember, last year the market anticipated four cuts, while for 2023, seven. However, a less "dovish" Fed approach did not prevent the market from pricing in the most "dovish" expectations.

Another serious factor behind the dollar's decline is technical. Open the monthly timeframe, and you will see that the downward trend persisted from November 2007 to September 2022—15 full years. No trend lasts forever, and the British pound (or euro) is not the Iranian rial, which can only depreciate. Global trends change, and the economy is cyclical. Therefore, in the coming years, the British currency could well aim to recover towards the $1.60 mark.

Another very important factor is the Trump factor. But not his policies, rather his passionate desire to depreciate the dollar as much as possible. The US President understands that increasing export volumes will be exceedingly challenging; thus, he is making two moves. First, he aims to reduce imports to offset the trade balance deficit. Second, he seeks to devalue the dollar to boost exports. This is the recipe for economic happiness from the American president. Therefore, from our perspective, the fate of the American currency is predetermined, both in 2026 and over the next five years. No one in the White House wants a strong dollar, and Trump's policies drive foreign investors away.

Thus, we believe the Bank of England meeting will not have a significant impact. Locally, its results could provoke both increases and decreases. Globally, nothing will change.

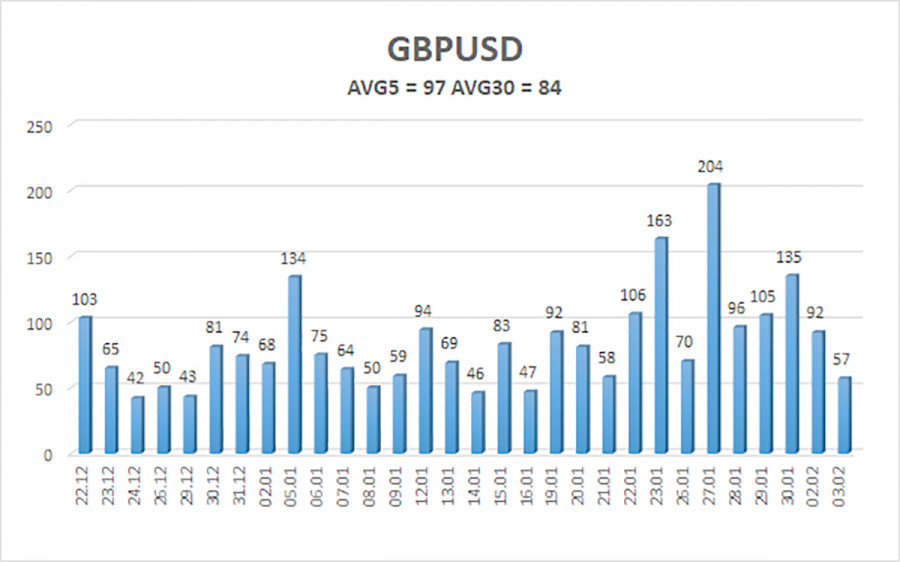

The average volatility of the GBP/USD pair over the last five trading days is 97 pips. On Wednesday, February 4, we expect movement within the range limited by levels 1.3600 and 1.3794. The upper linear regression channel points upwards, indicating a trend recovery. The CCI indicator has entered the overbought area six times over the past months. It has formed numerous "bullish" divergences, continuously signaling the impending resumption of the upward trend. An entry into the overbought area has warned of a correction.

S1 – 1.3672

S2 – 1.3550

S3 – 1.3428

R1 – 1.3794

R2 – 1.3916

The GBP/USD pair appears set to continue its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the US economy, so we do not expect the US dollar to grow in 2026. Even its status as a "reserve currency" no longer matters to traders. Therefore, long positions with targets of 1.3916 and above remain relevant in the near term when the price is above the moving average. If the price is below the moving average, small short positions may be considered targeting 1.3550 on technical (corrective) grounds. From time to time, the American currency shows corrections (globally), but for trend growth, it needs global positive factors.

RYCHLÉ ODKAZY