Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

The EUR/USD currency pair traded relatively calmly on Wednesday, although the word "calm" may not accurately describe the daily decline of the dollar. The most accurate picture of what's happening in the currency market right now can be seen on the daily timeframe. For example, over the last nine consecutive trading days, the dollar has closed lower against the euro than it opened. The decline isn't steep—the dollar is losing 20, 30, or 50 points per day—but it's consistent. Therefore, on lower timeframes, it may seem as though the pair's rise is weak or even absent. This is because the market is no longer in a rush to dump the dollar. Now it is selling steadily and deliberately—every single day.

And why shouldn't traders sell the dollar? News from across the ocean flows in constantly, and traders now have to track multiple topics at once to keep up and press the "buy" button. Previously, the trade war was the top theme, with everything else playing a secondary role in influencing the dollar's exchange rate. However, the list of critical topics has now grown to four or five. For two consecutive weeks, the market was emotional due to the escalation of the Middle East conflict. And traders were caught in a contradiction: geopolitical tensions traditionally provoke dollar buying (as a safe haven), but who in their right mind is buying dollars now?

Another important topic is the ongoing standoff between Trump and Powell. Recently, another conflict emerged: Trump vs. Musk. And yesterday, the U.S. Senate passed the "One Big Beautiful Bill." Initially, this law was promoted by Trump as a tax reform bill aimed at lowering taxes. However, as it turned out later, the law is not just about taxes. It also includes cuts to various healthcare programs for low-income groups, increased spending on defense and immigration, as well as reductions in government spending. This law fully reflects the essence of Trump's policy—American greatness comes at the cost of the American people. In both the trade war and the "Trump law," the burden falls on the lower-income population.

Think about it—who buys most of the Chinese goods now subject to record tariffs? Those who, for various reasons, cannot afford more expensive European or American alternatives. In other words, the lower-income groups. According to the "Trump law," taxes for the poor will be cut minimally, while oligarchs, millionaires, and billionaires will feel a much greater reduction in their obligations to the state. Thus, Trump collects the maximum from the poor while buying the loyalty of the rich. That's the essence of U.S. presidential policy.

As we've said many times, it's not our problem what policy the U.S. president pursues. The Americans chose Trump themselves. However, the dollar continues to react quite explicitly to any actions or decisions made by the Republican Party leader.

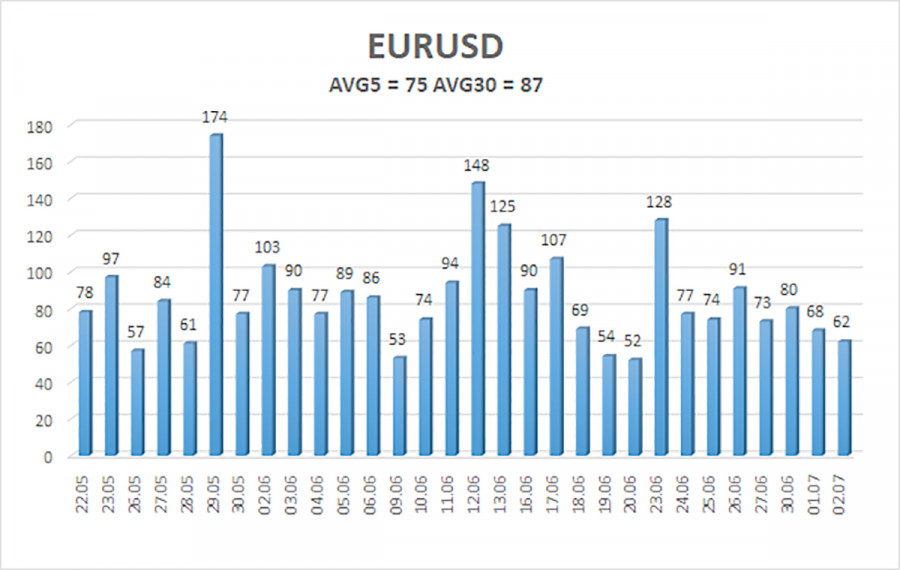

The average volatility of the EUR/USD pair over the last five trading days, as of July 3, is 75 pips, which is considered "moderate." We expect the pair to move between 1.1720 and 1.1870 on Thursday. The long-term regression channel is pointing upward, indicating a continued uptrend. The CCI indicator entered the overbought zone, but this only triggered a minor downward correction. Currently, the indicator is forming bearish divergences, but in an uptrend, these typically suggest only the possibility of a correction.

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

R1 – 1.1841

R2 – 1.1963

The EUR/USD pair remains on an upward trend. U.S. domestic and foreign policy under Trump remains the dominant bearish factor for the dollar. Additionally, the market is interpreting many data releases as dollar-negative or ignoring them altogether. We still note a complete unwillingness on the part of the market to buy the dollar under any circumstances.

If the price falls below the moving average, small short positions may be considered, with a target of 1.1597. However, under current conditions, a sharp drop in the pair is unlikely. Above the moving average line, long positions remain relevant with targets at 1.1841 and 1.1870 in continuation of the trend.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

QUICK LINKS