Yesterday, US stock indices closed lower. The S&P 500 fell by 0.82%, while the Nasdaq 100 dropped by 1.21%. The Dow Jones Industrial Average decreased by 1.07%.

The indices declined ahead of the earnings release from Nvidia Corp., which serves as a significant test for market stability after fears of overvaluation triggered a sell-off that resulted in a $1.6 trillion loss.

Investors are currently focused on whether Nvidia can meet high expectations, given its dominant position in the AI chip market. Any signs of slowing growth or inability to meet projected demand could trigger a new wave of sell-offs, impacting not only the tech sector but also the broader market. Concerns about the overvaluation of technology companies and their impact on overall market stability are intensifying as the year draws to a close.

The earnings report from Nvidia will be a key indicator of the market's future direction. A successful report could temporarily reassure investors and restore confidence by demonstrating the resilience of the tech sector. However, even in such a scenario, long-term risks associated with macroeconomic uncertainty will remain relevant.

Asian indices fell by 0.2%, continuing a decline for the fourth consecutive day. European indices opened relatively stable. Cryptocurrencies weakened again: Bitcoin briefly dropped below $90,000 but then regained its losses and rose above this level once more.

The S&P 500 index has already dropped more than 3% this month, and volatility within the index has surged. The CBOE Volatility Index, often referred to as Wall Street's fear gauge, has rebounded to 24 points, exceeding the concerning level of 20 points for traders.

Another important issue for investors is whether the Federal Reserve will cut interest rates next month. Traders are now less confident regarding further reductions in borrowing costs. Swaps currently imply a probability of such a scenario of less than 50%. Recently, several policymakers have voiced opposition to this measure, citing inflation risks, although Fed Chair Christopher Waller reiterated his stance in favor of lowering interest rates.

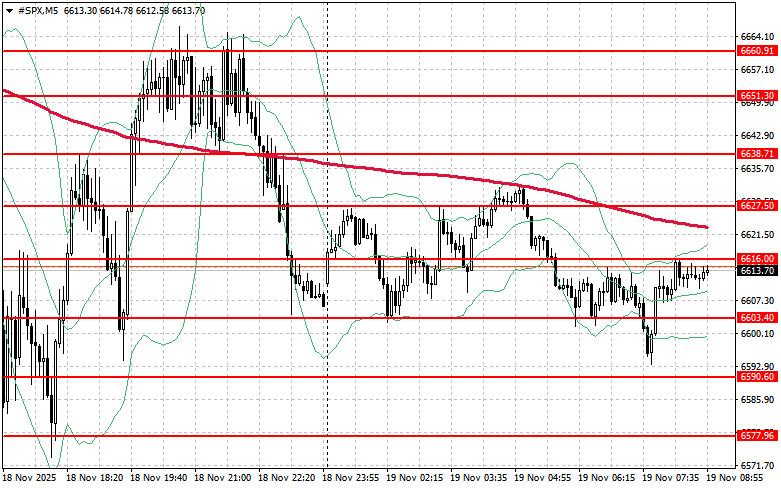

Regarding the technical picture of the S&P 500, the primary task for buyers today will be to overcome the nearest resistance level of $6,627. This would help the index gain ground and pave the way for a potential move to a new level of $6,638. Another priority for bulls will be to maintain control over the $6,651 mark, which would strengthen buyers' positions. In the event of a downturn amid reduced risk appetite, buyers must assert themselves around $6,616. A break below would quickly push the trading instrument back to $6,603 and open the way to $6,590.

QUICK LINKS