Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

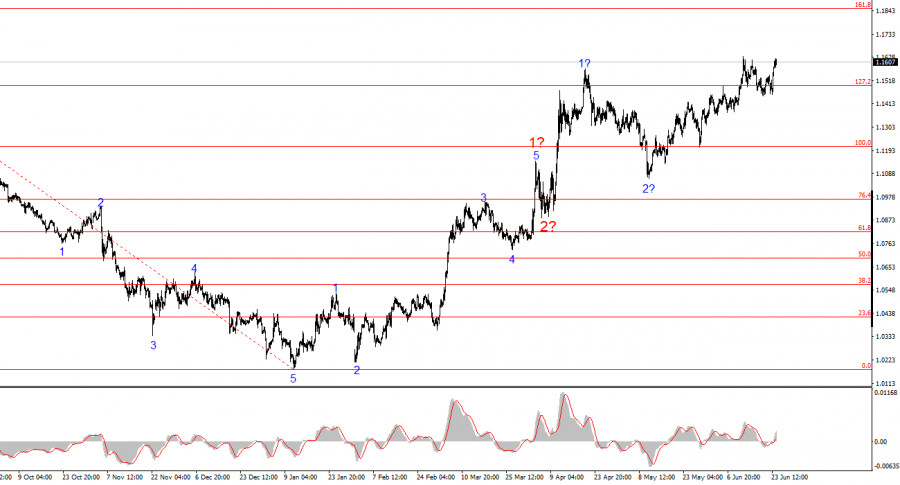

The wave pattern on the 4-hour EUR/USD chart continues to indicate the formation of an upward trend segment. This transformation has occurred solely due to the new U.S. trade policy. Up until February 28, when the dollar's decline began, the entire wave pattern appeared to form a convincing downward trend segment — wave 2 in a corrective phase. However, the trade war initiated by Donald Trump, aimed at increasing budget revenues and reducing the trade deficit, has so far worked against the U.S. currency. Demand for the dollar began to fall sharply, and now the trend that began on January 13 has taken the form of an impulsive upward move.

Currently, wave 3 of 3 is presumably continuing. If this is indeed the case, the rise in EUR/USD may persist over the coming weeks and months. However, the dollar will remain under pressure only if Donald Trump does not completely reverse the course of his adopted trade policy. At the moment, there is very little chance of such a reversal, and no basis for expecting a strong rally in the dollar.

The EUR/USD rate rose by 60 basis points on Monday and added several more dozen points on Tuesday. Anyone who developed a weekly trading strategy at the start of the week saw it fall apart by Monday. Market participants remain focused on developments in the Middle East — and on the central figure orchestrating this drama: Donald Trump. It seems the U.S. president has decided to manage a war between two countries directly from the White House, a conflict that may soon draw in neighboring states as well. Interestingly, Trump himself authorized a strike on Iran over the past weekend, arguing that America can do so — but others cannot. Also notable is the fact that Trump once again made the decision to strike Iran unilaterally, which has reignited discussions of impeachment.

Let's not forget that this is far from the first time Trump has made decisions without the constitutional authority to do so. Maybe in some countries one person decides everything, but in America — at least until recently — that has not been the case. Trump does not have the legal authority to impose global trade tariffs, use the military to suppress protests against him and his policies, or unilaterally order strikes against other states. All such decisions must be approved by the U.S. Congress. Otherwise, what is the point of Congress even existing? As for the market, it has grown tired of this political theater — and demand for the U.S. currency is falling again, which fully aligns with the current wave pattern.

Based on this EUR/USD analysis, I conclude that the pair continues to build an upward trend segment. The wave pattern remains entirely dependent on the news background tied to Trump's decisions and U.S. foreign policy. The targets of wave 3 may extend up to the 1.2500 level. Accordingly, I continue to view buying opportunities, with initial targets around 1.1708, which corresponds to the 127.2% Fibonacci level. A de-escalation of the trade war could reverse the upward trend — but for now, there are no signs of reversal or de-escalation. The conflict between Israel and Iran only temporarily halted the dollar's decline for a couple of weeks.

On the higher timeframes, it's clear that the wave pattern has shifted to bullish. A long-term upward wave cycle likely lies ahead — but news flow from Donald Trump personally is still capable of turning everything upside down again.

Key Principles of My Analysis:

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.