Australský provozovatel kasin Star Entertainment, který se ocitl v problémech, v úterý vykázal větší než očekávanou ztrátu za první pololetí, protože náklady na sanaci se stále zvyšují, přestože už má připravený záchranný balíček.

Náklady na nápravu v souvislosti s plněním přísnějších předpisů a nižšími diskrečními výdaji spotřebitelů vyčerpaly společnost Star Entertainment, což vedlo ke ztrátě ve výši 136 milionů australských dolarů (86,2 milionu USD) na základním základě za šest měsíců končících 31. prosince, uvedla společnost ve zprávě pro ASX.

Konsensus společnosti Visible Alpha předpokládal ztrátu 93,9 milionu australských dolarů.

Společnost Star Entertainment vykázala ve stejném období před rokem základní zisk 25 milionů australských dolarů.

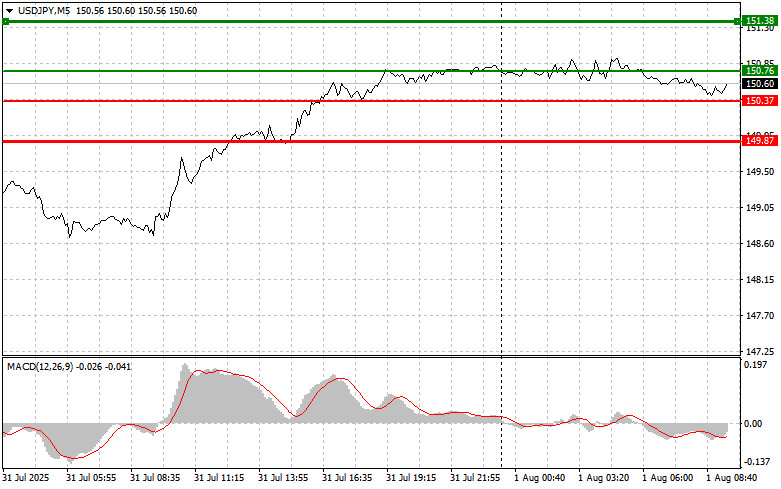

The test of the 150.28 level occurred when the MACD indicator had already moved significantly above the zero line, which, in my view, limited the pair's upward potential. For this reason, I did not buy the dollar.

The Bank of Japan's wait-and-see approach regarding interest rates, along with strong U.S. labor market data, served as drivers for further growth in the USD/JPY pair. The Japanese yen, traditionally considered a safe-haven currency, remains under pressure due to the divergence in monetary policies between Japan and the U.S. While the Federal Reserve continues its tight policy stance, the Bank of Japan maintains a dovish approach and is in no rush to raise rates further. This divergence creates favorable conditions for carry trade strategies, where investors borrow yen at low interest rates and invest in higher-yielding dollar-denominated assets.

Today's data on the recovery of Japan's Manufacturing PMI provided limited support to the yen, but it was not enough to trigger a broader decline in the pair. It only temporarily halted the USD/JPY's bullish momentum. Market participants seem to be viewing any signs of yen strengthening as an opportunity to buy the dollar at a better price.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today at the entry point near 150.76 (green line on the chart), targeting a rise toward 151.38 (thicker green line on the chart). Around 151.38, I intend to exit long positions and open short positions in the opposite direction, aiming for a 30–35 pip pullback from that level. The best time to re-enter long positions is during corrections and significant pullbacks in USD/JPY.

Important! Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY in case of two consecutive tests of the 150.37 level while the MACD is in the oversold zone. This would limit the downside potential of the pair and trigger an upward reversal. A rise toward the opposite levels of 150.76 and 151.38 can be expected.

Scenario #1: I plan to sell USD/JPY today only after a breakout below the 150.37 level (red line on the chart), which would likely lead to a quick drop in the pair. The key target for sellers will be 147.87, where I intend to exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 pip reversal from that level. Strong selling pressure on the pair is unlikely to return today.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to move downward from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 150.76 level while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a downward reversal. A drop toward the opposite levels of 150.37 and 149.87 can be expected.