The test of the 1.1633 price level occurred when the MACD indicator had already moved significantly down from the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro. I did not receive any other entry points.

Yesterday's strengthening of the dollar against the euro took place as part of a correction, but what happens next depends entirely on today's data. Figures are expected for the Eurozone ZEW Economic Sentiment Index and Germany's Current Situation Index. These indicators will provide insight into the current state of the European economy. Special attention is given to the Current Situation Index for Germany, as this country is the largest economy in Europe. The released data will be an important tool for investors and analysts seeking to assess how resilient the European economy is to current challenges. Geopolitical instability is currently having a significant impact on business activity and consumer spending. An increase in the indicators may indicate that the economy is gradually adapting to the new realities, while a decline, on the contrary, will heighten concerns about an impending recession.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

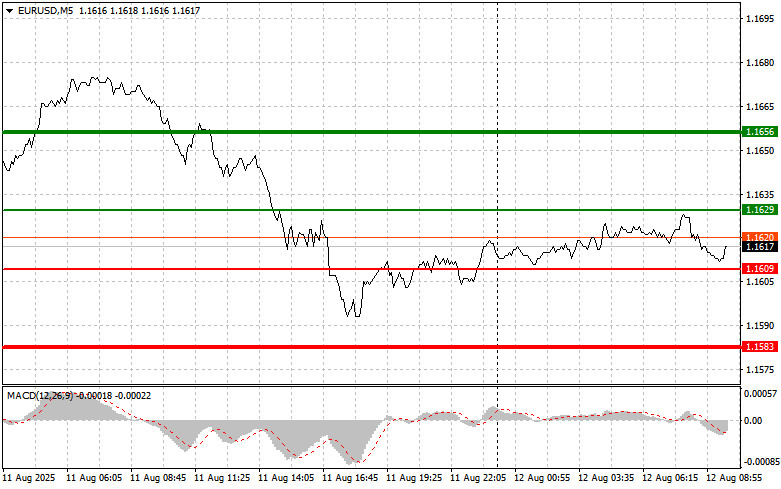

Scenario No. 1: Today, buying the euro is possible if the price reaches the area of 1.1629 (green line on the chart) with the target of rising to the 1.1656 level. At 1.1656, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35-point move from the entry point. Growth in the euro can be expected within the current upward trend. Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1609 price level at a time when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 1.1629 and 1.1656 can be expected.

Scenario No. 1: I plan to sell the euro after it reaches the 1.1609 level (red line on the chart). The target will be the 1.1583 level, where I intend to exit the market and immediately buy in the opposite direction (aiming for a 20–25-point move in the opposite direction from the level). Strong pressure on the pair is possible today following weak data. Important: Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1629 price level at a time when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.1609 and 1.1583 can be expected.