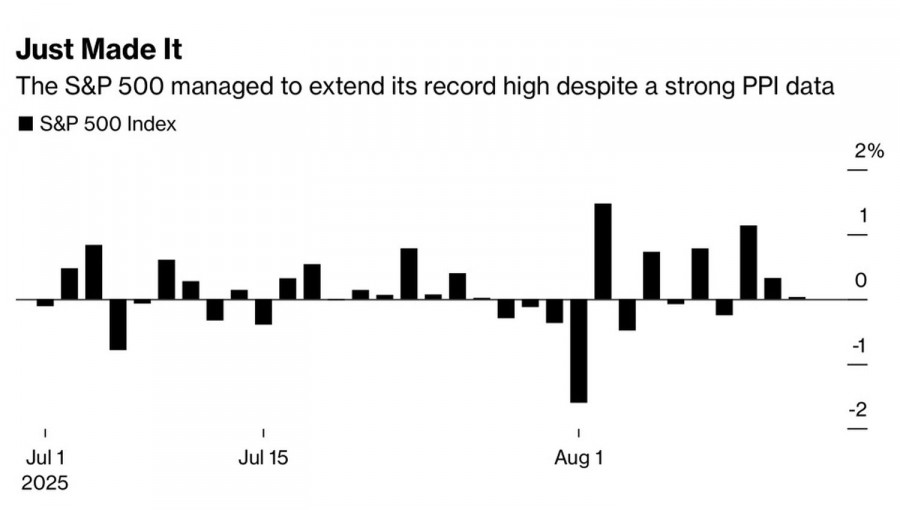

Markets once again brushed off bad news. The S&P 500 managed to close higher, holding up against the hit from the Producer Price Index. On a monthly basis, the PPI jumped by 0.9% in July, the fastest pace in three years. This trajectory paints a stagflation scenario. Only recently, consumer price data had led many to believe that the worst was over. In reality, anything can happen, and traders must be prepared for it.

The April sell-off in the S&P 500 after America's Liberation Day was driven by fears that tariffs would either accelerate consumer inflation, cut household spending, and ultimately push the economy into a recession, or that companies would absorb most of the burden and avoid passing higher costs on to households. This would hurt profit margins and drag the broad equity index lower.

US inflation and profit margin spread dynamics

Judging by the PPI's lead over the CPI, the second scenario is playing out. Companies are taking the hit themselves, and rising costs will negatively affect future earnings. Eventually, part of these expenses will be passed on to consumers, but for now, it makes sense to brace for weaker financial results from US corporations in the third quarter.

Even so, the S&P 500 did not fall thanks to expectations of the Federal Reserve resuming its monetary easing cycle. The broad equity index has closed in positive territory in six of the last nine trading sessions. Yes, surging producer prices have effectively ruled out a 50-basis-point cut to the federal funds rate in September. However, the Fed is still expected to ease monetary policy. As a result, lower US Treasury yields should help offset part of the tariff-driven cost increases for companies.

S&P 500 daily dynamics

A further weakening of the US dollar could also support the S&P 500 by boosting overseas earnings for US corporations. The Fed cutting rates while inflation accelerates is a rare occurrence, but it has happened before in US economic history.

In the second half of 2007 through the first half of 2008, supply chain shocks sent prices soaring. The Fed used monetary stimulus to support cooling labor and housing markets. As a result, the US dollar index dropped by 8%.

Thus, tariffs are a negative factor, but the US stock market has tools to counter them. Much will depend on the Fed's readiness to loosen monetary policy, with signals on the resumption of the cycle potentially coming as early as the Jackson Hole central bankers' meeting.

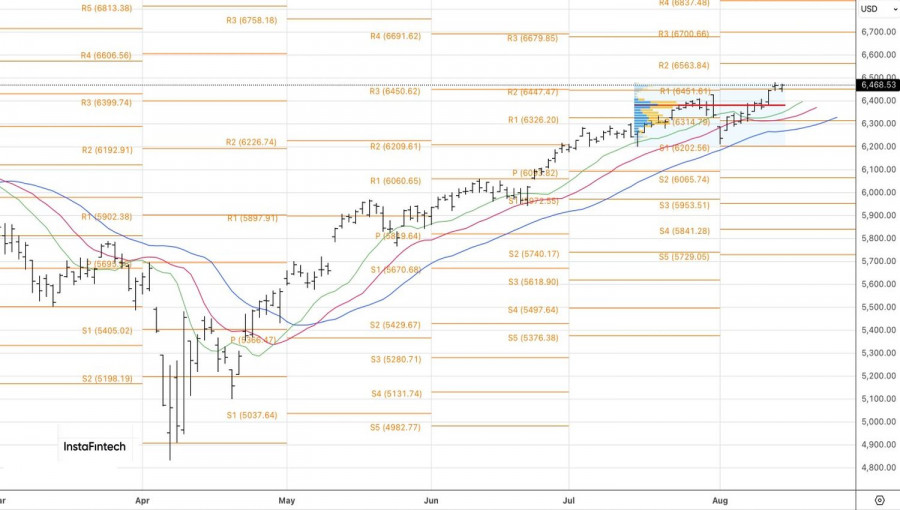

Technically, the daily S&P 500 chart still shows an uptrend. The key support is the pivot level at 6,450. If bulls can hold above this level, the chances of pushing quotes towards 6,575 and 6,700 will increase. As long as the broad equity index trades above 6,450, it makes sense to maintain a buy-side bias.