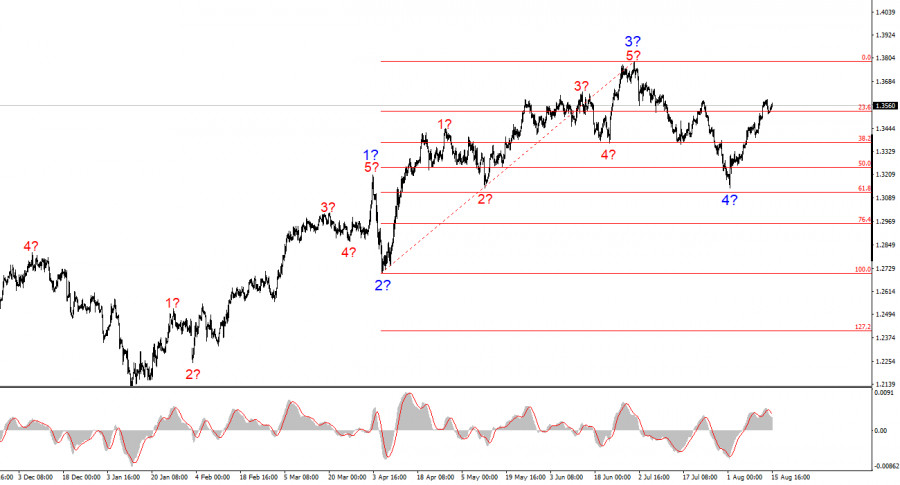

The wave pattern for GBP/USD continues to indicate the formation of an upward impulsive structure. The wave picture is almost identical to EUR/USD, as the sole "driver of the situation" remains the U.S. dollar. Medium-term demand for the dollar is falling across the market, resulting in similar dynamics across many instruments. At present, wave 4 is presumably complete. If this is correct, the pair's rise will continue within impulsive wave 5. While wave 4 could still take the form of a five-wave structure, this is not the most likely scenario.

It should be remembered that much in the currency market now depends on Donald Trump's policies — and not only trade-related ones. Positive news from the U.S. occasionally emerges, but the market remains focused on the overall uncertainty in the economy, Trump's contradictory decisions and statements, and the White House's hostile and protectionist stance in foreign affairs. Global tensions are rising, and, as mentioned, the main "culprit" remains the dollar — which is why it bears the brunt of selling pressure.

On Friday, GBP/USD resumed its rise, gaining about 40 basis points. I expect no major moves for the rest of the day and week. Tonight, the "event of the week" will take place — a meeting between U.S. President Donald Trump and Russian President Vladimir Putin, covering a range of important topics. However, the results of this meeting in Alaska will not be known until late at night or Saturday morning, by which time the currency market will already be closed.

There was no news flow from the UK on Friday, but three economic reports were released in the U.S. Retail sales volumes rose by 0.5% in July, in line with expectations. Industrial production fell by 0.1% month-on-month, compared to expectations of 0%. The University of Michigan Consumer Sentiment Index dropped from 61.7 to 58.6, while most traders had expected an increase to 62. Two of the three reports came in weaker than forecast. I do not believe these data had any real impact on market sentiment, as demand for the U.S. dollar had already started declining overnight. By the end of the day, I can conclude that the upward trend segment remains in place, and we are likely facing another prolonged decline in the U.S. currency.

Of course, Monday's opening could see a large gap, as no one yet knows how the Alaska talks will conclude. I suspect that Trump and Putin have already held certain discussions ahead of their face-to-face meeting, so I expect positive decisions. If the sides were not ready for compromise, there would be no need for an in-person meeting. In this case, demand for the U.S. dollar as a "reserve currency" could continue to decline on Monday. However, I repeat, this is only my assumption.

The GBP/USD wave pattern remains unchanged. We are dealing with an upward, impulsive segment of the trend. Under Donald Trump, markets could face many more shocks and reversals that may significantly affect the wave picture, but for now, the working scenario remains intact. The targets for the upward trend segment are now around 1.4017. At this stage, I assume that the downward wave 4 is complete. Therefore, I recommend buying with a target of 1.4017.

Key principles of my analysis: