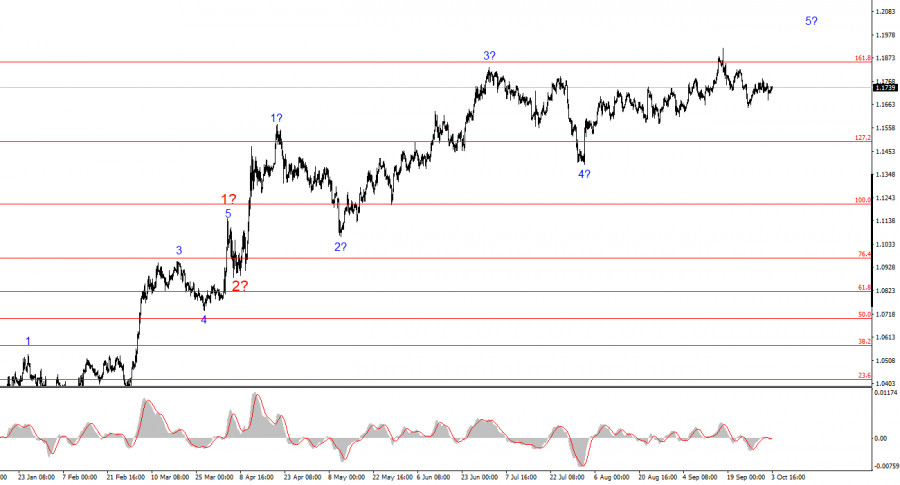

The wave structure on the 4-hour chart for EUR/USD has remained unchanged for several months, but in recent days it has started to take on a rather complicated shape. It is still too early to conclude that the upward trend segment has been canceled, but further complication of the wave pattern in the near future is quite possible.

The upward trend segment continues to build, while the news backdrop mostly favors currencies other than the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. The market's "dovish" expectations regarding the Fed's rate are growing. The market has a rather low opinion of Donald Trump's first 6–7 months in office, even though economic growth in Q2 was nearly 4%.

At present, it can be assumed that impulse wave 5 is still forming, with potential targets extending up to the 1.25 level. Within this wave, the structure is fairly complex and ambiguous, but its larger scale does not raise major questions. Currently, three upward waves are visible, which means the pair is in the process of building wave 4 within wave 5. This wave is taking the form of a three-wave correction and may already be complete. A stronger decline in prices would require adjustments to the current labeling.

The EUR/USD exchange rate barely moved on Friday, just as it has all week. The British pound at least moved somewhat, but the euro has been firmly stuck in place. The most interesting part is that it got stuck precisely at a time when the news flow was shaking the market almost daily. Perhaps "shaking" is not quite the right word, but admit it: a government shutdown + ADP report + lack of unemployment and Nonfarm Payrolls reports + inflation report — all of these are serious reasons to trade more actively, at least a little.

But trading this week was practically nonexistent. For obvious reasons, the wave structure has not changed in the past 5 days. Therefore, my conclusions can only be based on wave analysis for now. And that still points to a rise in the euro. The news backdrop this week also supported buyers, since the U.S. labor market once again showed very weak results.

This time, the assessment could only be based on the ADP report, which is considered less significant than the Nonfarm Payrolls release. Based on the factors outlined above, I did not expect and do not expect the U.S. dollar to strengthen, as its position continues to deteriorate. Now it is unclear when the shutdown will end, unclear what the labor market data for September and October will look like, unclear whether unemployment is rising, and even the mid-month inflation report is at risk.

Based on the EUR/USD analysis, I conclude that the pair continues to build an upward trend segment. The wave structure still depends entirely on the news backdrop — Trump's decisions, as well as the foreign and domestic policies of the new White House administration. The targets of the current trend segment could extend as far as the 1.25 level. At present, a corrective wave 4 is unfolding, which may already be complete. The upward wave structure remains intact. Therefore, in the near term I am considering only long positions. By year-end, I expect the euro to rise to 1.2245, which corresponds to the 200.0% Fibonacci level.

On a smaller scale, the entire upward trend segment is visible. The wave structure is not the most standard, since the corrective waves differ in size. For example, the larger wave 2 is smaller in size than the internal wave 2 of wave 3. But such cases also happen. I remind you that it is best to identify clear structures on the charts rather than to force every wave into the count. The current upward structure raises virtually no questions.

The main principles of my analysis: