(Reuters) – Americké ministerstvo práce zastavilo vyšetřování společnosti Scale AI ohledně dodržování zákona o spravedlivých pracovních podmínkách (Fair Labor Standards Act, FLSA), informoval v pátek TechCrunch s odvoláním na zdroj přímo obeznámený s touto záležitostí.

FLSA je federální zákon, který stanoví minimální mzdu, přesčasy, evidenci a další pracovní normy.

Vyšetřování se zabývalo dodržováním spravedlivých mzdových praktik a pracovních podmínek společností Scale AI. Bylo zahájeno před téměř rokem za vlády bývalého prezidenta Joea Bidena, uvedla společnost v březnu.

Společnost Scale AI na žádost agentury Reuters o komentář okamžitě nereagovala.

The U.S. dollar sharply weakened against the euro and British pound but managed to hold its ground versus the Japanese yen.

Yesterday's remarks from Federal Reserve official Christopher Waller — who stated he would support a more dovish monetary policy — put significant pressure on the dollar. Traders are concerned that Waller's potential appointment as the new head of the Federal Reserve could signal a long-term policy shift toward lower interest rates.

Today's key release will be the Eurozone Consumer Confidence Index for October. Though this indicator is unlikely to be a major driver for the euro in the immediate term, it remains a critical component in assessing the overall health of the euro area economy. Economists expect a further decline in sentiment, reflecting increased dissatisfaction among European consumers. If the report confirms weakening consumer confidence, it could influence the European Central Bank's monetary policy discussions.

For the British pound, attention will be on the UK CBI Industrial Order Expectations and a speech by Bank of England MPC member Swati Dhingra. Markets are awaiting the data to gauge the condition of the UK industrial sector. Economists predict a moderate improvement, which may lend temporary support to sterling. However, if outcomes disappoint, the pound could face fresh selling pressure. Dhingra's speech is also crucial; if she expresses concern about slower economic growth or emphasizes the need for further easing, that would likely weigh on the pound.

If actual data is in line with economists' forecasts, use the Mean Reversion strategy. If data significantly beats or misses expectations, use the Momentum breakout strategy.

Buying on a breakout of 1.1620 may lead to the euro strengthening toward 1.1645 and 1.1675

Selling on a breakout of 1.1590 may lead to the euro weakening toward 1.1575 and 1.1545

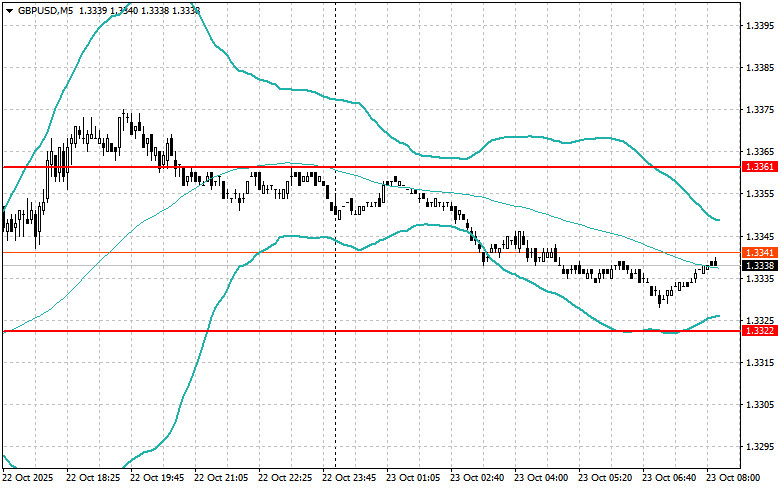

Buying on a breakout of 1.3350 may lead to the pound strengthening toward 1.3375 and 1.3400

Selling on a breakout of 1.3325 may lead to the pound weakening toward 1.3280 and 1.3260

Buying on a breakout of 152.50 may lead to dollar strengthening toward 152.82 and 153.12

Selling on a breakout of 152.30 may lead to a dollar pullback toward 152.00 and 151.70

Short positions may be considered after a failed breakout above 1.1609 and a return below this level

Long positions may be considered after a failed breakout below 1.1587 and a return above this level

Short positions may be considered after a failed breakout above 1.3361 and a return below this level

Long positions may be considered after a failed breakout below 1.3322 and a return above this level

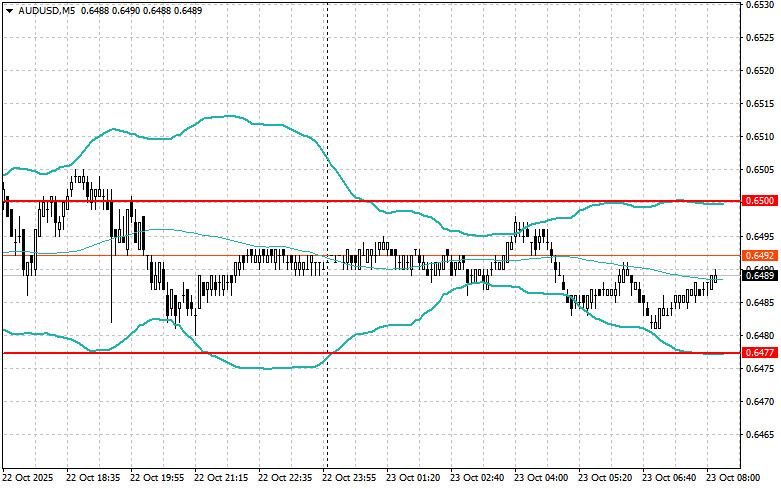

Short positions may be considered after a failed breakout above 0.6500 and a return below this level

Long positions may be considered after a failed breakout below 0.6477 and a return above this level

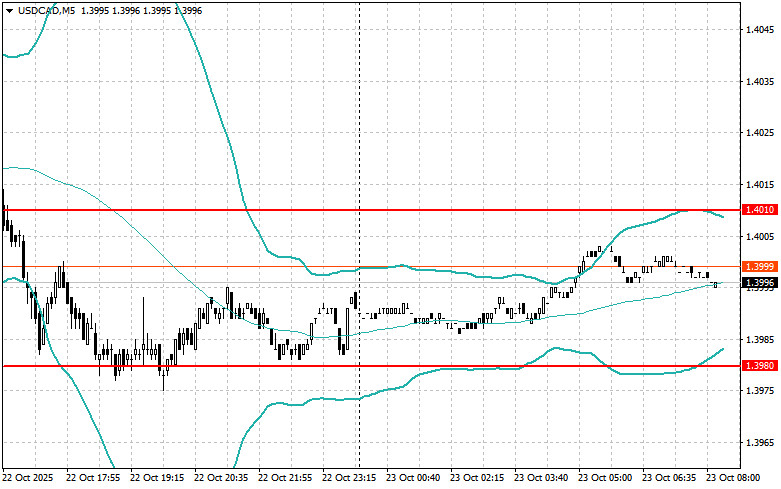

Short positions may be considered after a failed breakout above 1.4010 and a return below this level

Long positions may be considered after a failed breakout below 1.3980 and a return above this level

ລິ້ງດ່ວນ