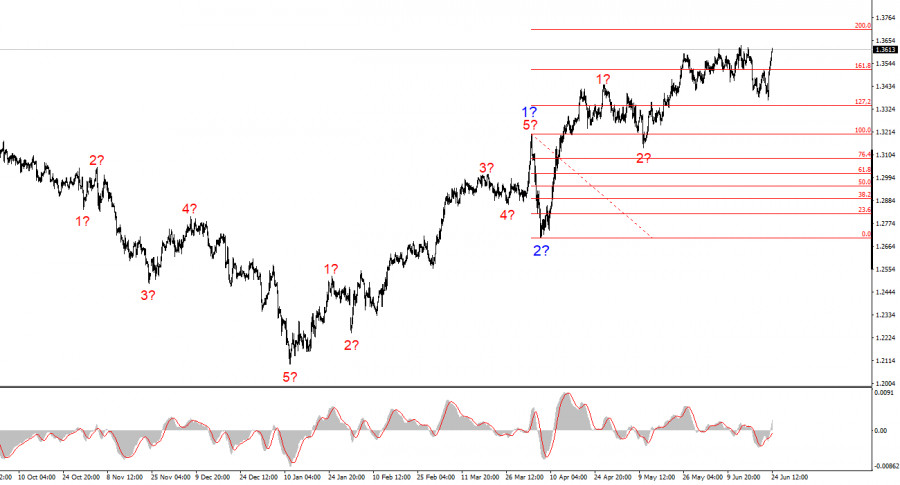

The wave pattern for GBP/USD continues to indicate the formation of a bullish impulsive wave sequence. The wave pattern is nearly identical to that of EUR/USD, as the main driver in both cases remains the U.S. dollar. Demand for the dollar is declining across the board, which is why many instruments are showing similar dynamics. Wave 2 of the upward trend has taken on a single-wave form. Within the presumed wave 3, waves 1 and 2 have already formed. Therefore, we are now likely seeing the continuation of the pound's rise within wave 3 of 3 — and that is exactly what's unfolding.

It's important to remember that much of what is currently happening in the currency market depends on Donald Trump's policies — not just trade policy. The U.S. occasionally releases decent economic data, but the market remains focused on the persistent uncertainty in the economy, Trump's contradictory decisions and statements, and the hostile, protectionist stance of the White House. As a result, it is very difficult for the dollar to convert even positive news into sustained market demand — and so far, it hasn't succeeded.

The GBP/USD rate rose by 75 basis points on Monday and added another 75 in the first half of Tuesday. This next surge didn't come after Jerome Powell's speech in Congress or after Andrew Bailey's Tuesday morning remarks. Instead, the market started dumping the U.S. dollar after America launched a missile strike on Iran, and Iran responded by shelling U.S. military bases in the Middle East — of which there are about 20.

However, the real twist is this: Donald Trump thanked Iran for warning him about the incoming attack. I think I'm not the only one wondering — how is that even possible? Yet the White House interpreted this "gesture of goodwill" as a first step toward a ceasefire and announced the end of the 12-day war on Tuesday morning. Just a few hours later, Iran launched missiles at Israel, which responded by scrambling its fighter jets. Another half hour passed, and news came in of an accidental missile launch by Iran — all while Donald Trump was attempting to "de-escalate" the conflict through social media.

Trump's last message was unfiltered, "They don't know what they're doing." However, it seems Iran and Israel know exactly what they're doing. The only one who doesn't understand what's happening appears to be just one person. This time, the market didn't bother guessing who attacked whom, who warned whom, or who made peace and who didn't. It simply resumed selling the U.S. dollar — something it has become quite used to over the past five months. One way or another, the U.S. is now a direct participant in the conflict, and Trump, in his unique style, brokered a peace that lasted barely a few hours.

The wave pattern for GBP/USD remains unchanged. We are dealing with a bullish impulsive trend segment. Under Donald Trump, the markets may experience many more shocks and reversals, which could significantly affect the wave structure. However, for now, the current working scenario remains intact, and Trump continues to do everything to drive down demand for the dollar.

The target for bullish wave 3 lies near the 1.3708 level, which corresponds to the 200.0% Fibonacci extension from the assumed global wave 2. As such, I continue to consider buying opportunities, as the market shows no signs of wanting to reverse the trend.

On the higher wave scale, the wave pattern has shifted to bullish. We can now assume the formation of a new upward trend segment, which currently appears incomplete. For now, only continued growth should be expected.

Key Principles of My Analysis:

SZYBKIE LINKI