The GBP/USD pair also traded higher, but in a much calmer and more familiar fashion. The trendline remains relevant, so only further growth of the British pound should be expected, both in the short and long term. Yesterday's UK reports were bland and were clearly not the reason for the pound's rise. US figures beat forecasts, but the market simply ignored them. Today, an important UK inflation report is scheduled for release in about an hour and a half. The Fed meeting is later in the evening, and the Bank of England meets tomorrow. Therefore, volatility over the next 24 hours could be elevated, and we might see a lot of sharp movements and reversals on the charts. The outcomes of both the BoE and Fed meetings can be predicted with 90% certainty already, but surprises are always possible. The Fed may be more dovish than traders expect—or the opposite. As such, caution is advised with any market positions today and tomorrow.

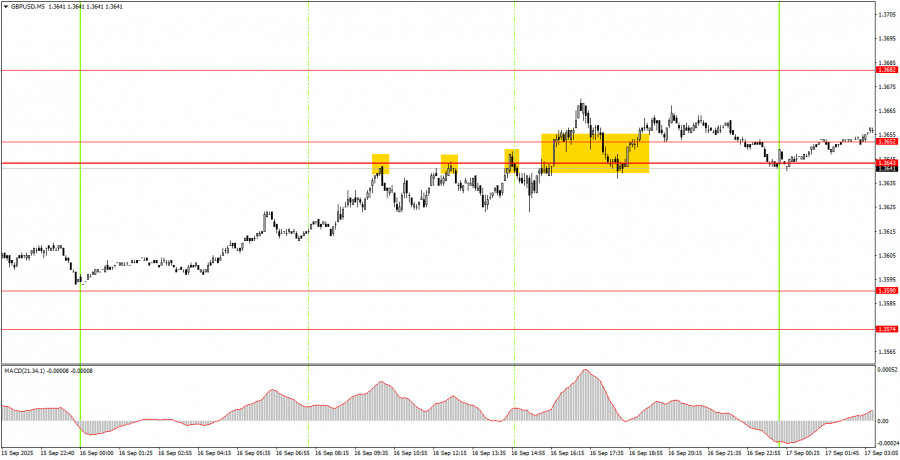

On the 5-minute chart on Tuesday, four trading signals were generated. First, the price bounced three times from the 1.3643 level but failed to move even 20 pips in the needed direction each time—these signals duplicated each other. Then, the 1.3643–1.3652 area was broken, but this buy signal also didn't yield profit, as the pound's rally had already ended by that time.

On the hourly timeframe, GBP/USD continues its uptrend; on higher timeframes, it shows signs of resuming the "2025 trend." As said before, there's no basis for expecting medium-term dollar growth, so we continue to anticipate further gains for the pound. Over the next 24 hours, price moves may be choppy and volatile.

On Wednesday, the GBP/USD pair may continue moving north, having successfully broken the 1.3643–1.3652 area. However, today and tomorrow's movements will largely depend on macro and fundamental events.

On the 5-minute chart, you can trade on the following levels: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. On Wednesday, the UK will publish a fairly significant inflation report, which could surprise with an unexpected August result. In the evening, the Fed decision and Jerome Powell's press conference will take place in the US—an event the whole world will be watching.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

LINKS RÁPIDOS