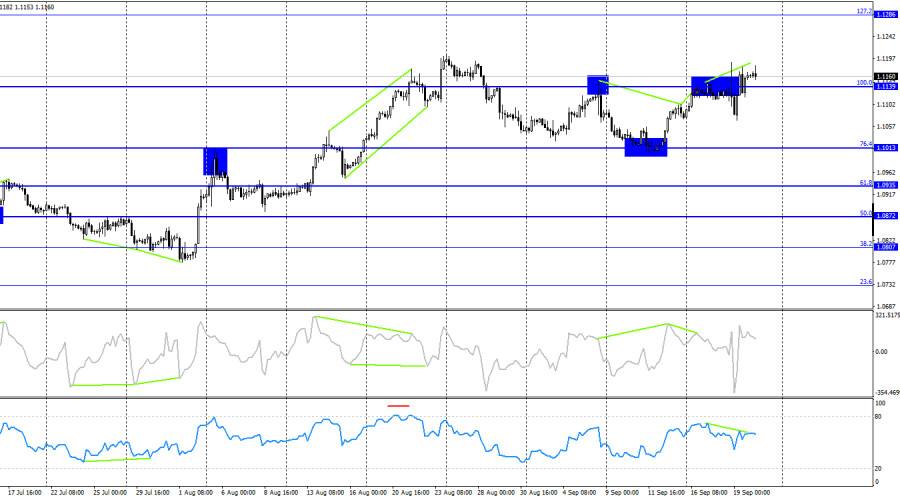

On Thursday, the EUR/USD pair rebounded from the support zone of 1.1070–1.1081, reversed in favor of the euro, and returned to the 200.0% Fibonacci level at 1.1165. There was no closing price above Wednesday's high, so the slight chances of a decline back to the 1.1070–1.1081 zone remain. However, the bulls are once again exerting strong pressure, and consolidation above the 1.1165 level opens the way for further growth toward 1.1240.

The wave situation has become somewhat more complicated, but overall, it is still understandable. The last completed downward wave broke the low of the previous wave, while the last completed upward wave broke the peak of the wave from September 6. Therefore, the bearish trend is now being reversed, and the pair is either entering a complex sideways movement or beginning to form a new bullish trend. However, it should be noted that the market situation is currently complicated, and any conclusion could turn out to be incorrect.

The news background on Thursday was rather weak for both the U.S. dollar and the euro, but the market continued to digest all the information received from the Federal Reserve. As a reminder, the FOMC decided to cut interest rates by 0.50%. Traders were both prepared and unprepared for this decision. On the one hand, many expected a 0.50% rate cut, but on the other hand, not everyone did, and this level of monetary easing tempted traders to sell the U.S. dollar. As of Friday morning, it appears the market has yet to determine which of these factors is more important. The dollar is on the verge of another drop, but there are few new reasons for its decline. The Fed has begun easing its monetary policy, but the ECB is also taking action. The Fed's interest rate may decline faster than the ECB's, but the European regulator started cutting rates earlier, which the market hasn't fully accounted for. Additionally, the ECB's rate was initially lower. Therefore, I wouldn't say the current news background is sharply against the dollar. However, the bulls are so strong that there are no sellers in the market.

On the 4-hour chart, the pair rebounded from the 76.4% Fibonacci retracement level at 1.1013 and consolidated above the 100.0% Fibonacci level at 1.1139. Two bearish divergences have formed on the CCI indicator, and the RSI indicator also showed a bearish divergence. The RSI entered overbought territory several weeks ago. A decline could begin, but given the strength of the bulls, it's hard to believe in it right now. In any case, there needs to be a consolidation below 1.1139 to expect a drop toward 1.1013.

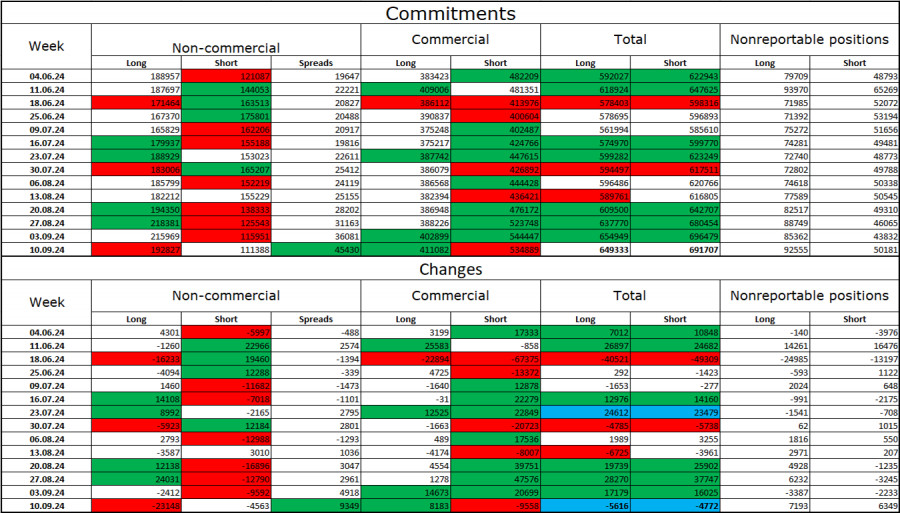

Commitments of Traders (COT) Report:

In the last reporting week, speculators closed 23,148 long positions and 4,563 short positions. The sentiment of the "Non-commercial" group turned bearish several months ago, but currently, the bulls are once again actively dominating. The total number of long futures contracts held by speculators is now 193,000, while short positions amount to just 111,000.

I still believe the situation will shift in favor of the bears. I don't see long-term reasons to buy the euro. It's also worth noting that the FOMC rate cut in September has likely already been priced in by the market. The potential for the euro to experience a significant decline is considerable. However, we shouldn't forget about technical analysis, which currently doesn't support a strong euro decline, as well as the news background, which continually puts obstacles in the dollar's path.

Economic Calendar for the US and the Eurozone:

On September 20, the economic calendar contains only one important event. The news background may significantly influence trader sentiment in the second half of the day.

EUR/USD Forecast and Trader Tips:

New sales of the pair are possible if it closes below the 1.1139 level, with targets at 1.1081 and 1.0984. Purchases can be considered if the pair closes above 1.1139, with targets at 1.1165 and 1.1286, but caution is advised with any purchases at this time.

Fibonacci levels are drawn from 1.0917 to 1.0668 on the hourly chart and from 1.1139 to 1.0603 on the 4-hour chart.

QUICK LINKS