Apple Inc (NASDAQ:AAPL) urychluje vývoj chytrých brýlí, jejichž uvedení na trh je plánováno na konec roku 2026, čímž se ještě více zapojuje do oblasti spotřebitelského hardwaru s integrovanou umělou inteligencí, informoval dříve Bloomberg. Výrobce iPhone odložil dříve zvažovaný Apple Watch s vestavěnou kamerou a zcela se zaměřil na brýle, které by mohly konkurovat partnerství Meta Platforms (NASDAQ:META) s Ray-Ban a nedávno oznámenému partnerství Google (NASDAQ:GOOGL) s Warby Parker (NYSE:WRBY) v oblasti AI brýlí.

Zdroje obeznámené s plánem sdělily agentuře Bloomberg, že Apple plánuje do konce tohoto roku zahájit velkovýrobu prototypů u zahraničních dodavatelů. Projekt N401, jak je nyní interně známý, představuje širší snahu o zavedení nositelných zařízení pro ambientní výpočetní techniku poháněných systémy umělé inteligence Apple, včetně Siri.

Brýle by měly podporovat kamery, mikrofony a reproduktory, což jim umožní analyzovat okolí uživatele a provádět úkoly aktivované hlasem. Zařízení by mělo zvládat funkce jako telefonní hovory, přehrávání hudby, navigace s podrobnými pokyny a překlad v reálném čase, což jsou funkce, které najdeme i v nejnovějších chytrých brýlích Ray-Ban od společnosti Meta.

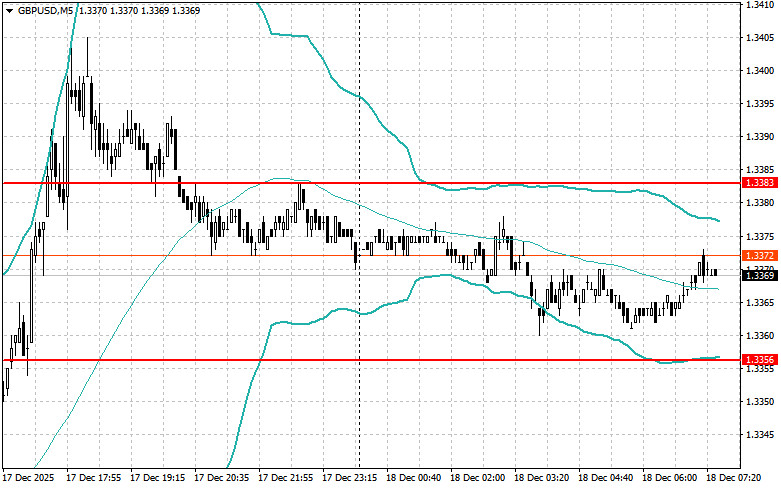

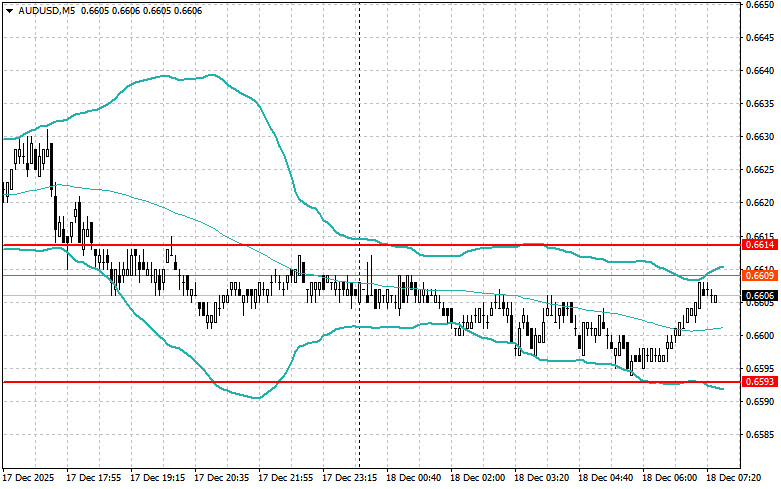

The euro and British pound quickly recovered from losses incurred in the first half of the day; however, a bullish market has yet to develop, and there are objective reasons for this.

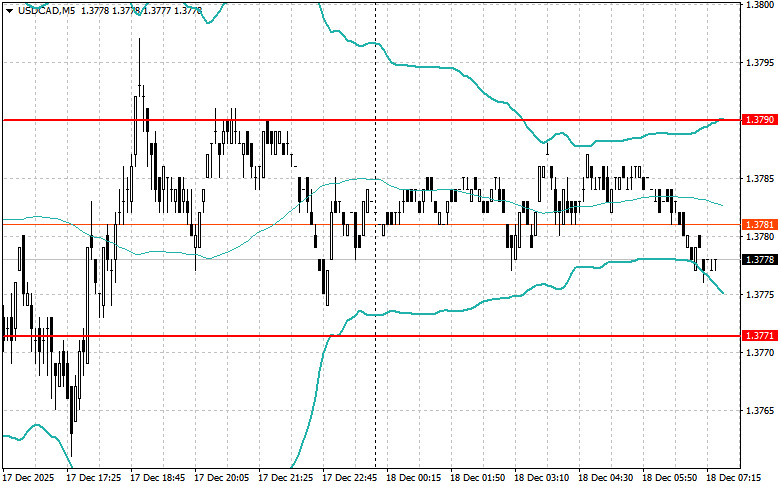

The dollar lost ground following dovish statements from Federal Reserve officials on future interest rates. Traders reacted to hints of further monetary policy easing. However, such a reaction could be premature. Today, several important decisions are expected that could overturn the current market picture.

A European Central Bank decision regarding the main interest rate is anticipated, as is a similar decision from the Bank of England.

Attention will be closely focused on Christine Lagarde's press conference as ECB President. Traders and analysts will be looking for hints about future easing measures amid slowing eurozone inflation. Any signals indicating a readiness for further stimulus could apply pressure on the euro. However, Lagarde is likely to maintain a cautious tone, emphasizing the need to assess incoming data while keeping options open for future action. She will likely avoid making concrete commitments to avoid constraining the ECB's future flexibility. New economic forecasts from the ECB will also be scrutinized.

Regarding the pound, the BoE's decision on the key interest rate may weigh on the currency. Most analysts are confident that the rate will be lowered to 3.75%. However, the most significant interest lies in the accompanying statement regarding monetary policy, as well as the subsequent comments from the BoE's Governor, Andrew Bailey. Markets will closely analyze every word to catch hints about the central bank's future actions. Traders are particularly interested in how quickly the BoE intends to continue easing monetary policy moving forward. It should be noted that this year, the regulator has followed a plan of quarterly rate cuts. If the BoE refrains from providing clear indications regarding future policy, volatility in financial markets could substantially increase.

If the data aligns with economists' expectations, it is advisable to rely on the Mean Reversion strategy. Conversely, if the data is significantly above or below economists' expectations, the Momentum strategy will be most appropriate.

QUICK LINKS