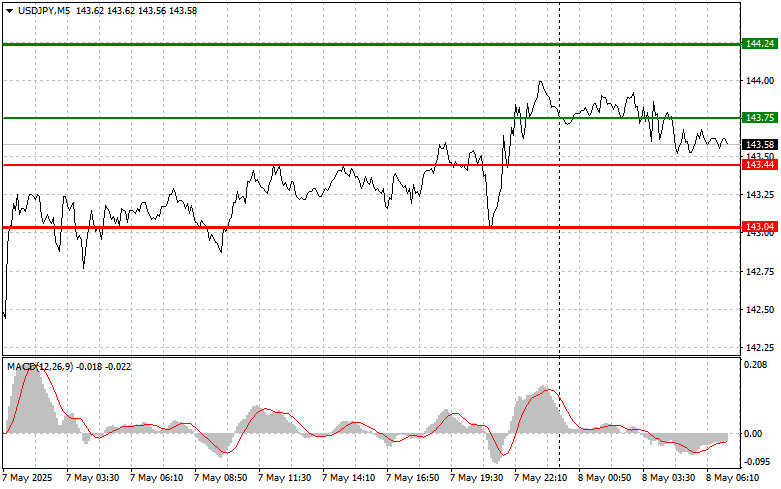

The price test at 143.18 occurred when the MACD indicator moved significantly below the zero line, limiting the pair's downside potential. For this reason, I did not sell the dollar. A similar situation occurred with attempts to buy the dollar after testing 143.55. When this level was updated, the MACD indicator had moved well above the zero line, which limited the pair's potential for further gains.

The dollar rose, and the yen weakened after the Federal Reserve left interest rates unchanged at 4.50% yesterday. Fed Chair Jerome Powell stated that officials are in no hurry to adjust interest rates.

Keeping interest rates steady gives the dollar short-term support but also poses risks to the U.S. economy. However, Powell's warning about inflation driven by tariffs introduces additional uncertainty.

Today, the Bank of Japan's monetary policy meeting minutes were published. However, the market showed little reaction. The moderately cautious tone of the report was likely already priced in, as the key discussion points, particularly regarding the likelihood of halting further rate hikes due to trade tariffs, were already known to traders. Speculative activity regarding the BoJ's next steps will likely increase in the coming weeks. Markets will closely monitor official statements or macroeconomic data that could provide insight into the central bank's intentions.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point at 143.75 (green line on the chart) with a target of rising to 144.24 (thicker green line). Around 144.24, I plan to exit long positions and open short trades in the opposite direction (anticipating a move of 30–35 pips back from the level). Buying the pair is best done during pullbacks or deeper corrections in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 143.44 level when the MACD is in the oversold zone. This will limit the pair's downside potential and trigger an upward reversal. A rise toward the 143.75 and 144.24 levels can be expected.

Scenario #1: I plan to sell USD/JPY today only after a breakout below 143.44 (red line on the chart), which could lead to a quick decline in the pair. The key target for sellers will be 143.04, where I plan to exit sales and immediately open long trades in the opposite direction (anticipating a 20–25 pip retracement). Strong pressure on the pair may return at any time. Important! Before selling, ensure the MACD indicator is below the zero line and beginning to fall from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 143.75 level when the MACD is in the overbought zone. This will cap the pair's upside potential and lead to a reversal downward. A decline toward the 143.44 and 143.04 levels can be expected.

QUICK LINKS